Why the bonus workbook?

When we set up Vencha, our SaaS growth consultancy, we cemented into our ethos from day 1 that we’d help Founders by doing free deck hacks of their Investor Proposition. We take ‘paying it forwards’ seriously and we’ve always been determined to support others in an industry that has treated us so well over the years.

Since we started, we’ve probably done over 250 deck hacks for SaaS businesses at various different stages of their growth and have immediately fed back our thoughts. Today, we still do half a dozen deck hacks a month – and we probably always will.

We thought therefore, as a bonus workbook, which so far has been focussed on Go to Market strategies, we’d add a chapter on how to put together a convincing Investor Proposition. That’s because there’s an argument that growing software businesses could and should always be raising money – their eyes firmly fixed on the horizon and the next significant raise. Several hundred deck hacks have taught us some important lessons which we thought could prove to be valuable to you here.

There are also so many little understood (but vital) acronyms that investors hold dear such as CARR, CAC, CLTV, DRR and may others. So, we’ll also take time in this chapter to demystify some of these terms too and explain why they are so important to investors.

Finding Founder/Investor Fit

As with your market facing Value Proposition, your Investor Proposition needs to hit the buttons of your target audience quickly and concisely. Equally, as with your sales process, it is essential to understand the criteria by which your target investors make decisions. Founders often refer to the fund-raising process as a soul destroying and demeaning experience. Unfortunately, what we have learnt is that this will continue to be the case until you find your Founder Investor Fit. We strongly advise that you take advice to avoid the costly distraction of speaking to the wrong investors.

What is an Investor Proposition made up of?

An investor proposition is made up of two essential items and you must concentrate on both.

- A short but compelling Investor Deck – usually 12-15 slides (this could be even shorter for early-stage investments)

- An easy-to-follow Financial Model that maps out the next 3-5 years P&L.

We’ll take a look at both of these individually, but let’s first have a look at the pitfalls that too many Investor propositions fall into.

The problem with many Investors Decks

What’s emerged from the hundreds of deck hacks we’ve done are several important observations.

- Most decks do an ineffective job at selling the real sizzle of their solution (‘the why’) and focus more on the sausage or in other words ‘the what’. 30 minutes into a deck hack, we suddenly get that all important ‘A-ha!’ moment when it should have hit us in the face from the first 2 pages. We need to get potential investors excited about your prospects within seconds of picking up the deck. Why is your solution a market hypothesis they can’t miss out on? They see thousands of propositions every month and yours needs to jump out at them.

- Many decks are far too long. Sometimes we see as many as 30 slides. The optimum deck length is 12-15 slides and if you’re an early-stage business this could be as little as 6-8. That should be more than enough space to convey the exciting merits of your solution. Anything longer and the potential investor may well push your deck away. They have short attention spans, so we need to make your proposition sharp. And you need to tell a story that is easy to understand and at great pace – we’ve seen too many decks where it’s hard to decipher the problem the business actually solves!

- Too often we find decks that are too wordy, and this is a real turn off for your Investor audience. A picture paints a thousand words, so use diagrams where you can. As long as the image is immediately understandable then it’ll have a more powerful effect. You can always explain your narrative further once you have a call or a meeting with an Investor. The deck’s primary function is to get you that meeting.

What Investors are looking for from your proposition

Having spoken to dozens of VCs (and other Investors) we can confirm that with your initial proposition and the narrative that goes with it, they’re primarily looking for your ability to tell a good story. As the famous phrase goes, ‘Money follows as a function of the story.’

In order to achieve investment, you must practice and get good at this and be able to relay your story in a simple and succinct way. What is it about your chosen market that you’ve spotted? What’s the pain the sector is in and how will you solve it? Why are you the team to disrupt and then dominate your category as opposed to your competition? What’s your secret sauce and why do you have an unfair advantage over others?

And don’t assume VC’s or other investors know the right questions to ask – they may not know your space and certainly won’t be aware of the customer challenges you’ve identified. They are there to be educated and inspired by you in equal measure. They want to understand what evidence you’ve built to prove your customers will take the risk with your software to solve their identified pain. They are interested in your process and how you’re going to convert a decent percentage of your obtainable market – they want to understand your vision. What is your armour piercing solution that allows you to land, and what are your product development plans that allows you to expand?

And don’t assume VC’s or other investors know the right questions to ask – they may not know your space and certainly won’t be aware of the customer challenges you’ve identified. They are there to be educated and inspired by you in equal measure. They want to understand what evidence you’ve built to prove your customers will take the risk with your software to solve their identified pain. They are interested in your process and how you’re going to convert a decent percentage of your obtainable market – they want to understand your vision. What is your armour piercing solution that allows you to land, and what are your product development plans that allows you to expand?

They’ll also want to understand whether your business is tapping into an existing category that won’t require millions spent on market education, or whether you’re planning to attack an emerging technology space that may be more expensive to develop. If you’re strategically aiming at the latter, you’ll need even more proposition clarity to explain how you’re going to succeed as this is untested. Who are you going to sell to and how do you plan to win?

The culmination of what we’ve learned

There’s a reason that this is the last chapter of the book because every exercise we’ve take you through leads to this point. Your investor proposition is the culmination of all you’ve done so far to visualise the pain, test your thesis to create evidence, build your market map and unleash your well-considered Go to Market Plan.

One final point before we look at the investor deck structure. During my conversations with Kam about this workbook, he let something slip. He said, ‘the most interesting products and the ones we’re most likely to invest in are those that get their Buying Personas promoted.’ We’ve mentioned this many times in the book before, so it’s great to get that validation.

The Investor Deck Narrative

There’s no question there’s an industry accepted framework for Investor decks – a narrative that it’s vital for Founders to follow. Investors expect information served up to them in a particular order so let’s explore this further.

This is the ideal slide order:

1. Defined Purpose and Vision. The deck should begin with a clearly defined Purpose and Vision that will seriously catch the eye of Investors. Explain in a short sentence how you are going to change the world and how it will look when you have. Think back to the work we did on your H1, the ‘above the fold messaging’ on your website. Can you, in as few words as possible explain:

- The Category you’re in – in other words ‘what you are’,

- The Audience you serve – who is it that gets most benefit

- The Macro benefit of your software for your customers

2. Who you’re for. This is the slide where you clarify the organisations, you’re for, and the particular problem or set of issues they have. If you’re for mid cap Legal firms, then make it clear – or if you’re for enterprise sized Utility firms then explicitly make that point. The Investor can then instantly understand your target market without having to work it out for themselves.

3. The effect of the problem. Here you are defining how the problem you solve manifests itself to these businesses and the financial, business, and personal problems it’s causing. The work you’ve done earlier on your Value Proposition will be invaluable here. You may well choose to incorporate your Pain Statement that we created earlier in the book.

4. How you solve this problem. This is your Solution slide that we covered off in an earlier Workbook. Unlike your Pain Statement, which proves there’s a mess that your software fixes, the Solution slide is neat and ordered and highlights all the areas customers can save time and money. This slide should evidence how easy it is to install your solution and how quickly the customer can get value. And it should clearly explain the time, money and heartache that you save.

5. Your commercial model. Here’s where you need to map out your pricing structure – how much you’re planning to charge each customer segment. This can evidence a Freemium of quick start/fast value level, right the way up to the average contact value of your Enterprise clients. Use the Pricing Workbook to guide you here.

6. How many companies have this problem? You need to get hyper familiar here with three important acronyms, TAM, SAM and SOM as they are often misunderstood.

TAM stands for Total Addressable Market which represents the total revenue opportunity of 100% of your defined market as if no competition exists. This is the global number as if every business in your target market in the world bought your product and may well run into billions.

SAM stands for Serviceable Available Market and is the segment of the TAM which is targeted by your products and services and is within your geographical reach. If your focus is on the UK, or even more specifically the southeast of England, this is your SAM and again should represent the entire possible market, given you had no competition.

SOM stands for Serviceable Obtainable Market and represents the portion of the SAM that you believe you can capture with the product that is ready to be sold today.

Why are these terms important?

The Serviceable Obtainable Market is your short-term target and therefore the one that matters the most. If you cannot succeed on a fraction of the local market, the chances are that you will never capture a large part of the global market. For the investor, the ability to reach your SOM means that he or she will not lose their shirt.

In this context SAM acts as a good sanity check to assess the likelihood of achieving the market share implied by the Serviceable Obtainable Market, and as a proxy for the short-term upside potential of your business.

If you can deliver on your SOM forecasts on time, then you are capable and credible, and you might be able to increase the market share and reach a more important penetration of the SAM which would deliver a good return on investment.

And then comes the Total Available Market. Once you have demonstrated your ability to penetrate a local market and de-risked the investment, the investor can start looking at how you can expand and increase the company’s penetration within the TAM. These acronyms provide the Investor with an important roadmap within which they can assess your ambition and understand their return on investment better.

Let’s get back to the deck.

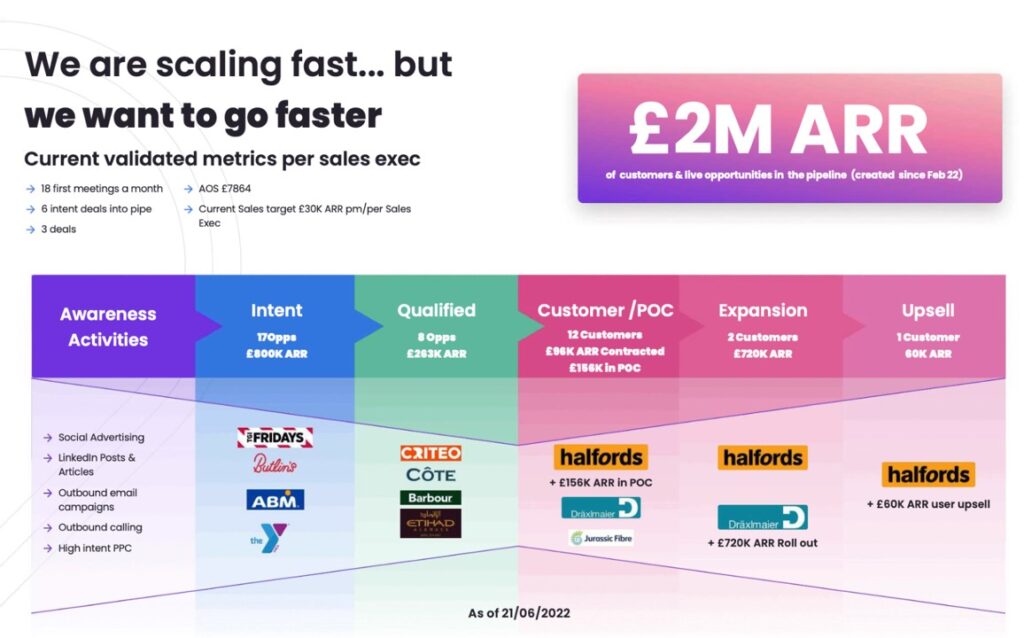

7. The proof that your thesis is real and works. Here’s where you’re telling your Investors that they should believe in your model because of the traction you’ve achieved so far. Here’s where you should list out all the customers who have bought your software and detail the contract values you’ve achieved for each. You might want another illustration here that we call the ‘bow tie’ that shows not just your closed clients but the pipeline too. Here’s an example below.

8. Future growth forecasts. The deck needs a slide that maps out your expected future financial growth. Clearly the full Financial Model you will submit with your deck (more details below) will give investors the detail. But here you want to be mapping out the highlights of your future growth expectations.

9. Your unfair advantage. This is an opportunity to explain your secret sauce, the reason you will succeed, and others won’t. This could be a unique technical moat you’ve created that simply can’t be replicated by your competition or something else that makes you stand out from the rest. This is a crucial aspect of your deck, especially in a crowded marketplace.

10. Horizon mapping. Finally, this is a slide where you can map out the dream. If you’ve not heard of McKinsey’s ‘3 Horizons model’ before, there’s a plenty about it on the internet, including explainer videos you can watch.

But for now, here’s a summary.

Horizon 1: In simple terms the first horizon of growth focuses on you leveraging your existing products and services within your SOM. It’s about executing on your targets and hitting your numbers, not just from a revenue perspective but also across the other metrics you’ve highlighted in your Financial Model. You could include product upgrades, new features or adding other services from your product roadmap, but these should be relatively minor and not a complete system rebuild. It’s probably about the next 12 months and it’s you are delivering everything you’ve said you would in return for the Investors money.

Horizon 2: The second horizon of growth focuses on taking what you already have and extending it into new areas of revenue-driving activity. It’s where you’ll be focussing on creating new innovations in the existing market and probably exploring new geographies. New customers, new markets, new targets.

Horizon 3: This horizon is the third and most distant of the planning horizons. It’s typically characterized by long-term goals and investments that have unprecedented strategic or competitive implications. For example, your organization could invest in the development of new products, the research and development of automation, and the development of new technologies or services. This is where you should be dreaming and dreaming big.

Again, an image that explains your thinking about how you believe your business can grow exponentially would be valuable here and a critical end point of your deck.

11. The Team. If you are looking for pre-seed or seed investment, you may want to push this slide right to the top – if you’re at a later stage this could come as validation towards the end of the deck. Most investors are actually more interested in the team at an early stage than they are in the financial model. They want to see both the talent behind the product and understand how you’ll go about attracting more talent down the line. In a perfect world they’d like to see a good balance between technical and commercial skills and experience or at least your plans to find (and reward) gaps in your team if they’re there.

There’s plenty of terrific resources out there to help with your deck creation and we certainly don’t hold the copyright!

Y Combinator for example have a great set of tips at https://www.ycombinator.com/library/4b-how-to-pitch-your-company so it’s well worth your while hunting around.

What does a business need to prove to get VC funding?

We’re often asked the question ‘what does an Investor need to see, to improve your odds of getting an investment?’ The answer is nuanced of course and depends on what stage the business is at. But at a Seed, Pre-Seed, or Series A stage we believe that companies need to prove the following.

- Survivability – there is a plan that gives you the space to prove product market fit and raise funding, or at the very least get to break even.

- The problem you’re solving is sufficiently painful that customers will pay for the solution and your sales & marketing efficiencies are clear. We’ve obsessed about customer pain throughout this book, and this is another reason why it’s so important

- The market for your solution is sufficiently large such that the business could deliver uncapped returns for investors. Be in no doubt that the only reason an Investor parts with their hard-earned cash is because they believe the returns, they can get back could be uncapped. Your deck and financial model need to reflect this

- Your Vision is exciting, the execution is disciplined and the sequence of battles to be won is clear. All of these aspects are important. Have you shown in your deck that you have a clear vision of how you intend to grow your business at great pace? Have you evidenced that you’ll stay within pre-defined guardrails and spend their money carefully? And have you mapped out your horizons in a believable way. They want to see your Vision and believe that you’ll achieve it.

- You bring an unfair advantage against the competition in acquiring and retaining customers. Define your secret sauce and how you’ll win when others didn’t. They’ll want to see if you have a technology moat too that will create long lasting differentiation and make it difficult for new entrants to replicate. So, if you have something unique, promote it in your deck.

- The business model is inherently capital efficient. We’ll touch on this again later in the chapter but your growth metrics such as customer acquisition costs, and customer lifetime value have been well assessed.

- Most importantly, companies VCs invest in are showing month on month, quarter on quarter sales growth. The faster growth the better – this is literally catnip to investors.

The Financial Model

A critical but often overlooked aspect of your Investor proposition is the Financial Model, the Excel spreadsheets that can mean the difference between securing investment or being turned away.

Creating the model will almost certainly require the services of someone with experience in this field. They may need to be involved in its creation from the start or at the very least will add significant value checking your logic before it is submitted to Investors.

However, we thought it would be good to list some important pointers when putting your Financial Model together.

- Who is the model actually for? It’s for you first and Investors second. This model should be your guiding star as you begin to scale or rescale your business. It contains the critical metrics about running your day-to-day business, and you should be referring back to it constantly. Create it for your benefit first and for your Investors second.

- How many years should I forecast? You should project forward a minimum of 3 years and a maximum of 5. Looking too far into the future can be challenging as there are so many moving parts. But this is the optimum time frame.

- Where should I start revenue wise? You should begin by what you realistically know today about your business such as your typical sales month and the targets you’ve already set for this calendar year. That’s the top line of your forecast. You should then, in other rows of the spreadsheet, overlay the upside you envisage being added as you bring on new product lines, more customer growth, price rises and perhaps, where applicable, geographical expansion.

An example of this increased revenue overlay would be from moving your business into fresh horizons. We discussed the importance of Horizon mapping earlier in this chapter and why it’s important your plans for expansion in stages is visualised in your deck. These phases must be mapped into your financial model. If you are exciting your Investors by the possibility fresh markets might bring, you have to include the financial upside.

- How bold should I be about growth? Get the balance right between pipe dreams and a believable growth forecast. A good tip here is to constantly cross reference back to your predicted market share, from the work you’ve done with your SAM and SOM. A 10% market share is clearly more rational than forecasting you’ll own 80% of the market.

What’s critical though, is that you have the narrative to support the increased revenues reflected in your strategic vision. At some point an Investor will want to talk you through your Financial Model and you need to have corelating stories between your deck, your strategy, and your forecasts.

But if you asked Investors, they’d define good growth as 50-100% in a year, better as 100-200% and best as 200%+.

- Should I forecast churn? Yes, and you need to be realistic. A churn factor needs to be added to your model (as a negative) as time rolls by, because it is inevitable you will lose customers along the way. Predicting zero churn would be a warning light to Investors, as every SaaS business loses a percentage of customers in its lifetime. You may have low churn today and that’s great, but that might not always be the case. You can make this number formulaic in your model, such as 5% or 10%.

- Why is sales capacity important? It’s important that your maths makes logical sense, especially when it comes to the relationship between sales heads in your business and the quotas you have set them. This will be checked. If you have a forecast revenue increase of £3m of ARR in a certain year, but only 2 sales heads with a quota of £1m ARR, your model will be flawed.

- What are your key denominators for growth? This will depend on the Go to Market model you have created. If your vision is to create a business built on Enterprise sales, say via account-based marketing, then your growth will be driven by the sales head count. Your model will be built ‘bottom up’ with revenue being added each time you hire a salesperson and provide them with a quota.

If your vision is to build a Product Led Growth business, with most transactions done without sales intervention, then your growth should align to your marketing spend. This is more of a ‘top down’ model where the more you spend in marketing, the more revenue should hit your bottom line.

- How can I adjust my cost and growth assumptions? The best way is to break out your assumptions around hiring, marketing spends, sales growth, churn percentages and so on, onto a separate sheet. This will make them easily referenceable and will help your forecast modelling as you can adjust them up and down to see the effect they have.

The final point here is to remember that your Financial Model is simply your best guess at this stage and comes with a multitude of variables. The reality, as your business grows or reshapes, could be quite different. Don’t fall into the trap of either getting too bogged down with this or try and make the model too complex. Investors will want to see a well thought through plan with revenues increasing as your planned strategic expansion come into play.

Get some external help here too. There are plenty of great fractional CFOs and financial operatives out there who have experience with this, so get them to support you.

Unravelling the financial metric acronyms

When building your financial model, and indeed throughout your career as a SaaS leader, it is important that you keep some key metrics at the forefront of your mind. There’s no doubt that Investors today will expect you to be fully conversant with some mind spinning acronyms, so we thought we’d dedicate a section of this book to explaining some of them and their critical importance to your business.

Here’s a summary and an explanation of each

Committed Annual Recurring Revenue (CARR). This is the single most important metric for you to monitor, as the change in recurring revenue growth provides the clearest visibility into the health of your business. CARR is defined as contracted, but not yet live ARR, plus live ARR netted down against projected churn. It’s why keeping a close eye on this metric is so important. As mentioned above 50% is good, 100-200% is better and 200%+ is best.

Cash Flow. Companies live or die based on their cash management, and it’s vital that you track your burn rate closely. Comparing burn rate to top line growth allows you to understand what growth initiatives are working (or not), where headcount can be added (or taken out), and what extra finance you will need. If cash flow is going to be a challenge it might make sense to offer customer discounts and sweeteners for payment of cash up front.

Customer Acquisition Cost (CAC). This is a metric you’ll need to become very conversant with. In simple terms, CAC is the total sales and marketing expenses incurred by the business, divided by the number of new customers you’ve acquired during the period.

Included in the sales and marketing costs should be all advertising and marketing spend, commissions and bonuses paid, salaries of marketers and sales managers, and overhead costs related to sales and marketing over the measurement period. So, if you’ve planning to spend £300,000 on sales and marketing salaries, bonuses, commissions, and marketing spend and, in the year, you bring on 10 new customers, your CAC would be £30,000 per customer.

The next most obvious question is what a reasonable CAC number is. To assess this, you need to understand the relationship between CAC And Customer Lifetime Value.

Customer Lifetime Value (CLTV). CLTV is the value of the recurring profit of a given customer minus the acquisition cost of that customer.

CLTV is calculated by taking the total contract value, multiplied by your gross margin, divided by your CAC. Let’s look at an example, using the CAC Metrics we’ve established above.

Let’s say a customer buys your software for £50,000 and signs up for 3 years. Your Financial Model shows that you are making 70% gross margin on each sale. The total contract value therefore is £150,000 which means you’ve made £105,000 in gross profit (£150,000 x 70%). You now need to assess your CAC, which using the example above is £30,000. Your CLTV is therefore £105,000/£30,000 or 3.5 to 1.

In principle, a CLTV/CAC of 3x would be defined as Good, a 3-5x as Better and a 5x as Best. If you’re not achieving this sort of CLTV/CAC ratio you need to look back at your forecasts and costs and see what needs to be adjusted.

Customer Acquisition Cost (CAC) Payback Period. CAC payback is the time period needed to fully repay your sales and marketing expenses, on a gross margin basis.

CAC payback periods for business selling to SMB’s should be approximately 6-18 months whereas for those selling to enterprise customers, could be as long as 24-36 months. But as a rule of thumb, Good could be defined as 24 months, better as 12-24 months and best less than 12 months.

Use the £30,000 CAC cost detailed above and see how long, based on the gross margin per customer, it takes your business to repay the money it invested in acquiring the new customer.

Churn. Long term profitability, and thus your ultimate valuation, is impacted by the renewal rate of your customers. It’s critical you keep a close eye on this churn percentage number.

There’s clearly a huge a lot of information to ingest here and the outlines above are purely a guide. Take the time to read up on each acronym (there’s many sources online) so you get totally familiar with these terms, and they enter your vernacular. Investors will be doing their own maths off the back of your Financial Model so make sure you have all the answers to their questions to hand.

What sort of Investors are you looking for?

When you begin your investment journey it’s a great idea to think about what sort of investor suits your business best. Whoever’s money you take, you need to make doubly sure you’re completely aligned in terms of outcomes.

Very often when we first talk to Founders, we ask them to close their eyes and imagine the size of the cheque they’d like to receive upon exiting their business. What’s the number they are striving for? Is it £10-50 million or is it £1 billion plus? This exercise is crucial because it will help steer what sort of Investors you’re looking for. Of course, the answer is often, ‘as much as possible’ but everyone has a vague idea at the very least. Take the time to reflect because there’s a big difference when it comes to investor aspirations.

Tier 1 VCs

Many Founders believe that taking an investment from Tier 1 VCs is their optimum choice, but there are some caveats here.

- Tier 1 VCs will only invest in businesses that will return their fund – they are hunting unicorns. It’s important to understand that VCs lose far more bets than they win. They would define themselves as a brilliant Investor if 1 in every 3 cheques they write pay off – yes that’s correct, two thirds of the bets they make lose and that’s a good outcome!

So, when you’re pitching your business to a Tier 1 and you’re sure you want their money, you need to make them believe that you’re the fund returner they are looking for. Do the maths. Let’s say they have $200 million in their fund for investment, and you’re offering them a 20% share of your business. You need to produce a story and a plan for you to exit at $1 billion so that they get $200 million return (at 20%).

So be honest with yourself from the get-go about what sort of exit you’re looking for. Shut your eyes and dream. If you have the energy, ambition, product, market size and 24/7/365 drive to create a $1 billion business, then these could be the guys for you. If not, then you might want to consider different backers.

- Tier 1 VCs only invest in 1% of the decks they see, so your odds are not high. They are Unicorn hunters (and Unicorns don’t exist!) – that’s the standard line. If you’re going to invest the time and money going after a Tier 1, understand your chances of success. Kam sums this up with a brilliant analogy. Tier 1 VCs like Notion, where he is a Partner, sell jet fuel which is only suitable for jets. Stick that in a motorbike and the outcome would not be pretty to watch for either the rider or the firm selling the fuel. Tier 1 VC funding can destroy the wrong business – if you fall off their growth trajectory, further investment may well dry up. And he goes on to say there are 700 million motorbikes in the world and 23,000 jets. Do the maths.

- Tier 1’s will also want you to have given thought to who you believe will invest in the round that follows theirs. They will want you to evidence the proof points over the next 14-18 months that means a significant ‘up round’ can be achieved down the line. This will deliver the Tier 1 a significant mark up on their original investment. You may not have all the answers today, but you need to demonstrate the process and identify the key growth metrics and milestones.

Securing an investment from a Tier 1 with the PR, kudos and support this can bring is incredible and there are some amazing success stories to review. But go into this process with your eyes wide open about the reality.

They are looking for uncapped returns and this is not for the faint hearted!

Tier 2 VCS/Angels/VCT’s/Family Offices

These Investors might be more suitable to businesses for whom the Tier 1 VC journey looks daunting. Don’t think for a second that these parties lack ambition or growth aspirations and that you don’t need to create an exciting investment proposition. You absolutely do.

But their aspirations might well focus on 6-10X returns on their investment and they may be prepared to see a longer runway to lift off.

Selecting the right Investors for your business is critically important and again, guidance and advice about which route to take can be found from experienced consultants in this space. An awful lot of shoe leather can be saved by not knocking on the doors of the wrong Investors, so it’s a great idea to get an external view on suitability.

Workbook Summary

- Despite your best efforts, you’ll always be raising so keep your Investor proposition fresh.

- Too many decks focus too much on the What and not enough on the Why. They are often too long and too wordy. You have to grab Investors attention with an exciting but simple Investment Proposition.

- There are two key parts of an Investor proposition – the Deck and the Financial Model. Each need to be exciting, well-structured but most importantly clear and easy to understand.

- There’s a recognised formula to creating B2B SaaS decks – it’s worth following the order we’ve highlighted

- You may well need help putting together the Financial Model – look for an experienced finance professional for support

- Get really familiar with the common industry metrics and acronyms. You’ll be asked about them a great deal across the investment process

- Understand fully what the Investor is looking for from your proposition – the key metrics and milestones you’ll achieve to secure the next funding round

- Define the investment partner that’s a perfect match for your business and seek out expert guidance for advice.

Ready to ignite growth for your

B2B SaaS business?

Hyper growth for your business is just around the corner. Submit the form and the Vencha team will be in touch as fast as humanly possible.

We're excited to begin this journey with you.