Getting uncomfortably narrow

People often ask us what the number 1 trap that business to business software companies fall into, and our answer is invariably the same. They haven’t got ‘uncomfortably narrow’ when focussing on their Ideal Customer Profile. Why do we understand this problem so well? Because we’ve fallen into the same trap ourselves, too many times to mention. It’s such an easy mistake to make. Our inbuilt generosity of spirt means that our natural inclination is to be all things to all people. And this especially happens when it comes to selling software.

When we start our business, we’re desperate not to say no to anyone – any customer and especially their revenue, is the oxygen we need to survive. We’re so grateful they’ve said yes, particularly the early customers and we’re thrilled we’ve made a sale. We run along a line of figurative machine guns desperately looking for a place we’re not being repelled. And when we find a gap and someone says yes, we take that as evidence that we’ve found Product Market Fit and have struck gold.

But over time, different customers from competing verticals will have conflicting needs, and they’ll demand that you build functionality just for them. Your biggest customers in particular will have the loudest voices. And you are so keen to please everyone that you end up pleasing no-one. Sales people will yell at the product team claiming that if we build this particular feature in the product, ‘everyone will buy it’. I should know, I’ve been the yeller.

What you end up with from a product point of view is a total mess. A hodgepodge of different features that serve only a minority of customers and are impossible to resell to others. If everything is too generic, everything is watered down. Your marketing messages become too non-specific and within your product, you suffer from what seems like eternal feature creep.

In Rob Fitzpatrick’s, The Mom Test he discusses how to select your ideal customers and looks at some of the big names.

“When we look at the big successes, they seem to serve the whole world. Google lets anyone find anything. PayPal helps anyone send money anywhere. Evernote backs up all the writing of everybody. But they didn’t start there. In their early days, Google helped PhD students find obscure bits of code. PayPal helped collectors buy and sell Pez dispensers and Beanie Babies more efficiently. Evernote helped mums save and share recipes. When you have a fuzzy sense of who you’re serving, you end up talking to multiple customer segments all at once which leads to confusing signals.”

Before you can be everything to everyone, you have to be something to someone.

The problem is that as software Founders, our ideas on who we can help are limitless. We can solve so many challenges faced by thousands of different companies whether they be small medium or large. We want to improve the lives of so many people and prove our genius at an Enterprise scale – that’s what we were put on the earth to do. We’re going to be a Unicorn and we’re going to help everyone.

But we have to do this in stages – even Alexander the Great only conquered one country at a time. The critical focus on the first 12 months of your business is to hustle your way to 25 ideal customers who successfully implement and utilise your software.

Finding the middle of the Dartboard

Deciding what your perfect customer looks like is not an exercise in limiting ambition. We will get round to solving pain for the whole market. But we have to focus at this stage on customers who are suffering the most personal and business pain as defined in the previous chapter. You now have evidence that their processes are broken, and you have a solution to fix it. These are the customers who will be the most likely to buy, and at great pace and they are the businesses for whom our software will return significant value fast.

This is where the majority of our focus must be, and this also comes with the realisation that we’re going to have to switch off our marketing activities into organisations that are not 100% ideal. This is the most agonising part of the advice we give Founders and deciding which market segment we should focus on is always a difficult task.

Most business-to-business software companies have neither the time nor the money to focus anywhere other than the middle of the dartboard. This is not to say that other companies will not approach us down the line and ask to buy our software. That’s fine, and always will be. We will of course react to these enquiries and follow them up as actively we would any inbound lead. But the job here is to define here the dream customer – the perfect fit.

Defining the Perfect Customer

In order to define our perfect customer, we need to define some parameters. Close your eyes and write down the characteristics of what your perfect customer looks like.

- Where are they based geographically?

- How many employees do they have

- Which vertical are they in?

- What Buying Personas do they have?

- What’s their turnover?

- What particular issues do they have?

- What departmental budgets do they have access to?

- Are they able to sign off at pace?

- Can we return value to the customers quickly?

Remember this is your perfect customer with the perfect length buying cycle and the maximum amount of pain as drawn in the visualisation you’ve created.

If you’re wondering which market segment you should address first, it’s never a bad idea to review your existing customer base. In which verticals and with which organisational size has your software landed most successfully so far? Where have your sales team had the most success and which sort of organisations are capable of making a quick decision based upon the annual contract value of your solution? Which customers recognised your software’s value the fastest? Where are the costs to acquire and serve most efficient? This should give you a really good hint as to where to focus your attention moving forwards. Get uncomfortably narrow, be hard on yourself. For fear of repetition here, this is your PERFECT customer.

Consider how the real goldminers do it

Paul Watson, the co-author of this book, explains this really well using his past experience as a mining geologist working down a deep level goldmine in South Africa. He has always subconsciously related what we do today in software, to how he worked in mining all those years ago.

The first job a mining company has to do is invest a vast amount of money identifying the ore body, which in software terms is the customer pain. This is our gold! And that is why we’ve started this book by reconfirming the Value Proposition, understanding customer pain and confirming its veracity with real life prospects.

The next job they have in mining is to evaluate the extent of the ore body, its value, and the cost to extract and process it. They learn early on, not to mine the deepest part of the ore body unless you have specialist expertise, a high appetite for risk and very patient backers.

You can see the analogy here. For us, deep mining may well be going after Enterprise customers straight out of the gate, but you need to know these sales come with long buying cycles and may require a very significant amount of investment to acquire. Equally well, going after low-grade deposits, which we might equate to smaller contract values, is fine as long as you have a highly efficient business as a starting point. This is why having a clear view of your ideal customer is so important.

This mining analogy continues to add value. Mining companies need to prove to themselves, and their investors, the undeniable evidence of the opportunity. They will carefully study borehole data that shows the extent and grade of the mineralisation and the geological complications they’ll need to tackle. In software terms this is the research we’re encouraging you to do with target customers, gathering data along the way about their internal pains and the impacts the broken process has on the organisation and its people. In mining, a small amount of data points won’t pass muster and the same should apply to you. This is deep, extensive research. It’s a specialist discipline. Software Founders should not expect anyone to back the organisation without this research having been done.

At 4th Contact we found the confidence, once we had our messaging right, to go after Enterprise level customers, because we now clearly understood the challenges and pain they had. And they all had the same problem which was the excoriatingly painful process of administering employee benefits.

In contrast, there are other software businesses who are very efficient in acquiring customers (in terms of customer acquisition cost, more later) and therefore are comfortable serving the lower cost end of the market effectively. This is where getting external help from your Board, your investors and even better your customers may be extremely useful when deciding on your Ideal Customers.

We talk obsessively about this with the Founders we work with. Your seam of gold is your seam of gold and its critical not to be distracted by any by-products until you’re well established. We’ll talk about horizon mapping your product later in this book, but recognising what is a future opportunity versus a distraction is one, if not the most, important disciplines of a Founder. Mine the gold, avoid the waste and keep evaluating on the rock face – make it a regular activity. This is why checking in with your customers is so important.

Create an ICP grid

Another exercise that will really help you focus your thinking is to create an ICP grid. This will help you, and indeed your entire team, recognise which customers you need to obsess about and which, for now, you need to ignore.

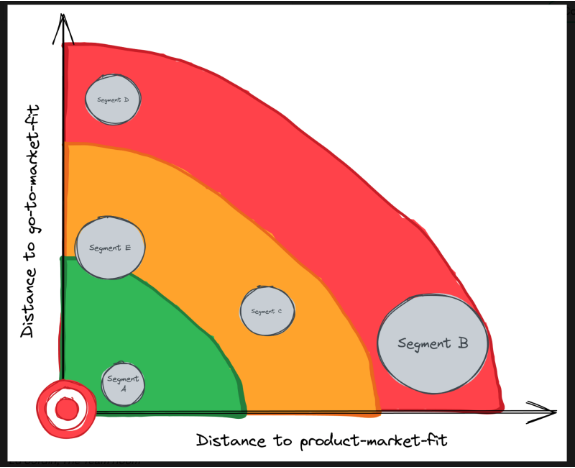

We’ve always found creating a graph like the one below a useful exercise. Draw in the X and Y axis and mark the Y axis with Product Market Fit and the X axis with Go to Market Fit. Product market fit means those customers that you believe today are perfectly suited to your solution – the absolute centre of the dartboard. So, you might say manufacturing companies based in the UK with 300 employees and an incumbent HR director. Go to Market Fit relates to how easy it is to get in front of these organisations or at the very least to get their contact details.

The top right hand side of the diagram where PMF is high as is Ease of Access, is where you need to have all of your attention. These are companies for whom your solution fits perfectly and who you’re comfortable getting in contact with. That’s why it’s labelled Focus and this segment represents your bullseye..

In the bottom right hand corner where PMF is low, but these companies are easy to get in contact with, this is labelled Respond. As discussed earlier in the book, companies will approach you from outside of the bullseye and that’s great. You can respond to them like any other inbound lead.

In the bottom left hand corner where there’s low PMF and these organisations are hard to get hold of, you need to completely Ignore this segment. Why try to sell to the NHS if your solution doesn’t suit them and they are incredibly hard to get hold of.

Finally, where product market fit is high, but your team are finding it hard to establish contact, this area is labelled Research. We know that they’ll like the solution when they see it, but we need to think of highly inventive ways of getting face time with the correct buying personas. We dedicate a whole chapter to Creating Demand later in this book.

Another way of drawing this grid was recently shared with me by the brilliant team at Notion Capital.

Think deeply with your team

Regather the same team that helped create the pain statement you designed in chapter 2 and ask them to explore what an ideal customer looks like. Begin to write onto the grid the different types of organisations either from your pipeline or from any other research you’ve already done. This should really help you focus on where the low hanging fruit lies and, just as importantly, which segments of the market you should ignore. Remember, all your marketing efforts moving forwards should be centred on the organisations listed in the top right hand corner of the graph.

With this exercise completed you should have a clearer view of the type of businesses for whom your solution is perfect. And don’t worry at this stage if it feels like a much smaller service obtainable market (SOM) than you created on your Investment deck. This exercise is to get right to the centre of the SOM rather than address every business you could possibly engage with. This smaller subsection should be easy to connect with, feeling the maximum pain and because of that will close at a faster pace. Getting uncomfortably narrow means both those words. Uncomfortable and narrow. This is all about laser focus.

Distil the ICP yet further

Now we’ve completed this exercise, there’s always value in distilling these customers down one more time. There are two more factors you might also like to add in here.

Firstly, which of the businesses in our Focus quadrant are high growth and secondly, which customers do we most admire and we most like to work with. This last factor is important. It’s worth choosing customers you admire and enjoy being around as selling software is hard work. It can be a real grind if you’re cynical about the people or the industry you’re trying to understand and serve.

Creating laser focus

Hopefully, you’ll find this exercise of defining what your Ideal Customer Profile looks like extremely rewarding. Again, external facilitation might help, so think about bringing in someone independently to take your team through this. They’ll be strong opinions all around the room – sales will think one thing, your Co-Founder another. We’ve spent many painful hours in rooms trying to get alignment on this as well and it may take several goes to get it right.

But if done well, you’ll now be in a position to provide your team with a far narrower focus. You can discard that campaign you were planning to large utility companies, industrial giants, and Public Sector bodies. You and your team will take great confidence in the fact that the seeds that you will begin to sew will fall on already fertile ground. You know these customers have this problem and you know they’re easy to get hold of – you need to spend all your time in this segment.

Also take comfort in the fact that will come back to these other organisations we decided to discard at a later date. We will conquer them all. But for now, we need to make the next 50 sales as fast as we can to build you and your team’s confidence as well as your investors.

Workbook Actions

- Think deeply about what a perfect customer looks like for your organisation. Where can sales, software adoption, usage and value be quickly achieved?

- Don’t fall into the trap of thinking you can serve every customer in your market. They’ll all want different things.

- You must get uncomfortably narrow when defining your PERFECT customer. We’re looking for the middle of the dartboard here.

- Use your existing customer list to give you some clues or close your eyes and consider what an ideal customer looks like based on size, geography, and speed to value for the customer.

- Consider using the ICP grid to help focus you and the team

This exercise should provide you with a narrow but focussed visualisation of the subset of the market where your software will land most fruitfully. Now we need to assess the size of this market and create a face book Market Map, so we can literally look in the eyes of our next 250 Buying Personas.

Ready to ignite growth for your

B2B SaaS business?

Hyper growth for your business is just around the corner. Submit the form and the Vencha team will be in touch as fast as humanly possible.

We're excited to begin this journey with you.